GREEDWASHING: Anatomy of an unfolding home repossession scandal

4 August 2024

My story by Tom Roche – Founder of Just Forests

Background to this PTSB scandal

“When my funding was cut as a result of the financial scandal that brought Ireland to its knees, I knew what was happening and I was straight into PTSB in Tullamore. I didn’t delay one minute and I said I have lost my job, I have no livelihood coming in and I’m going in to sign on social welfare.”

Tom Roche sitting outside his modest two-bedroom bungalow in Rhode, Co. Offaly.

In June 2022, I signed over ownership of my home to the iCARE/PTSB Mortgage to Rent (MTR) Program. I was led to believe this was a done deal. At the end of November 2022, almost six months later, I was informed (by email from MABS) that the deal had fallen through. Dissapointly, MABS solution was to hand me a ream of documents and said I should commence the MTR again. I refused, citing my deteriorating physical and mental health. I said its up to iCARE and PTSB to resolve the matter. I had done everything asked of me to engage in the MTR process. I made a formal complaint to the Financial Services and Pensions Ombudsman (FSPO). They took on my complaint.

For the past 18 months I have struggled to carry on life as I once knew it. Today I am devastated.

Political and Judicial Accountability

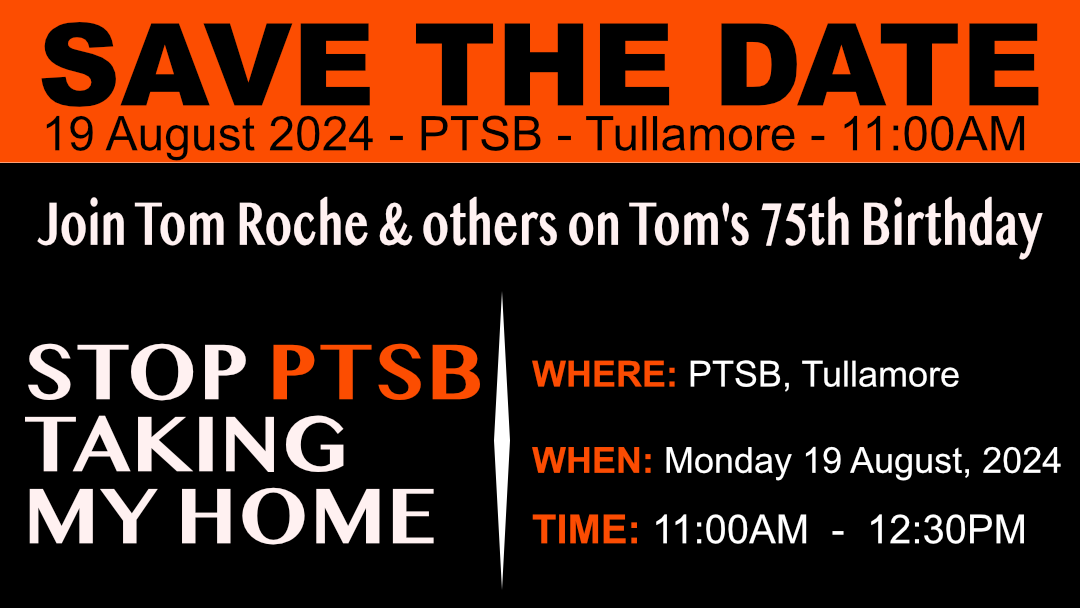

The “ENOUGH IS ENOUGH March for JUSTICE” (on Wednesday 18 September, 2024 at 11:30am – The Four Courts, Dublin) is not just a protest march; it’s a declaration of intent around our resilience, unity, and determination. Together, we demand justice, better support for victims, proper investigations and enforcement by regulators and a judiciary that does not favour the powerful.

We hold all political parties accountable to address these pressing issues. It’s our collective duty to challenge the status quo and demand positive, progressive, and purposeful reform — because ENOUGH IS ENOUGH!

We say “Enough is Enough!”

An Inquiry into the Central Bank of Ireland

We demand a comprehensive investigation into the systemic failures of regulation that have allowed financial misconduct by banks and vulture funds to thrive in Ireland. The many issues include the grotesque conflict of interest of the regulator as the supposed guardian and protector of consumer law while regulating banks in such a lax manner. We suspect that the atrocious performance of the Central Bank of Ireland has been a contributory factor in all the carnage that has been caused and we are demanding the opportunity to expose it for what it is – a regulatory failure!

We say “Enough is Enough!”

For more on the ‘ENOUGH IS ENOUGH’ Campaign click here…

Any fair-minded judge or barrister, with some knowledge of the cause of the financial crash, would have to agree that the decision by PTSB at this time, to issue proceedings for re-possession of my home and sell it off at a greatly reduced price to a vulture fund while my complaint against PTSB has advanced to the ‘Dispute Resolution’ stage with the Financial Services and Pensions Ombudsman (FSPO), is downright wrong and needs serious reprimand.

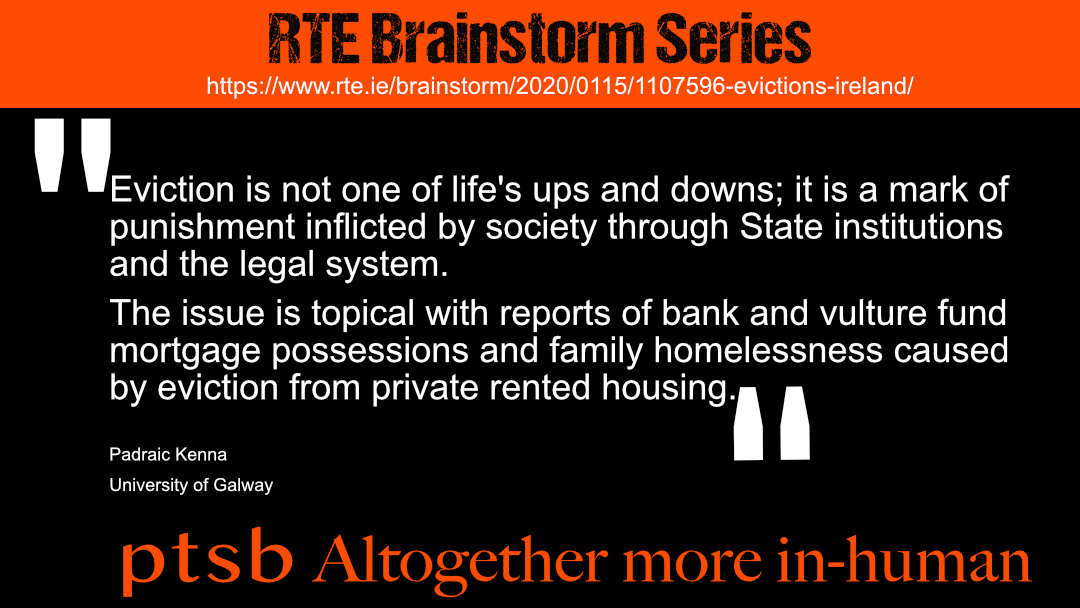

PTSB spent millions sponsoring community initiatives across Ireland. I call it GREEDWASHING.

Like the fossil fuel industry sponsorship programs known as GREENWASHING, corporations and banks do this kind of thing in a sycophantic attempt to ingratiate themselves with communities while they kick families out of their forests (their family home), as is the case with Texaco in the Ecuadorian Amazon, or as is the case here in Ireland with banks when they kick distressed mortgage holders out of their family homes.

Recently, we were reminded of the long-term effects the financial crisis has had on certain cohorts of Irish society. In July 2024, Ireland’s criminal law barristers staged three separate one-day strikes outside several courthouses across Ireland. They were demanding the reversal of pay cuts imposed on them in the aftermath of the financial crisis.

While I fully support them in their quest, unlike the criminal barristers however, I don’t have the support of a professional body to fight my case like they do. I would like the barristers to bear in mind that only a small number of those responsible for the criminal acts that imposed the cuts in their salaries and brought the country to its knees and forced the Irish tax payer to invest 64 billion to bail out the banks have been prosecuted.

Whereas, thousands of us ordinary law-abiding citizens, through no fault of our own, have been sentenced to a lifetime of worry, sleepless nights, anxiety, stress and suicide. I lost my salary as a result of the banking scandal and now I am about to lose my home.

Photo #1 ©Irish Independent: Tom Roche takes part in the Raise The Roof Campaign organised by the Irish Congress of Trade Unions in October 2019 outside the Dail.

Photo #2: Ireland’s Criminal Barristers protest outside The Four Courts in Dublin in July 2024.

Photo #3: Thousands of people from all walks of life take part in the Raise The Roof Campaign organised by the Irish Congress of Trade Unions in October 2019 outside the Dail.

In what was described by Lisa O’Carroll, business journalist with The Guardian, as ‘an extraordinary intervention’ at the time – one of Ireland’s most senior high court officials, Edmond Honohan said, some banks who were “cheerleaders of the Celtic Tiger” were “reverting to type” and pursuing people to “the bitter end” even when they “had no money”. He went on to say the “new debt set” have “legal rights” but some are made feel like “outlaws.” In the same article Mr Honohan said he had met several widows of people who had been “driven to suicide” because of the distress of debt.

Prior to the banking scandal (which I had no act or part in) I was financially secure (through Government funding for my Development Education (DE) work with schools) and quite able to meet my mortgage and mortgage protection policy payments.’

I am looking for a just and equitable resolution to this matter. Yet, for the past 15 years I have been made feel like an outlaw even though I broke no laws and had no act or part in causing the banking scandal. And before members of The Bar of Ireland consider taking on a case of home repossession for any Irish bank or Vulture Fund, I would like them to consider the following OPEN Letter to Mr. Seán Guerin SC and come to my/our aid.

According to Helen Slattery, Mortgage Manager at SYS Mortgage Group in Limerick, “We are currently in a cost-of-living crisis with the costs of food, electricity, fuel etc all continuously increasing. It is unrealistic to expect families to sustain these high-interest rates while the cost of living increases. They are at a serious disadvantage when they are at the mercy of rates being offered by vulture funds. This could be our next unfolding scandal and the start of our next arrears crisis.”

Open Letter to

Mr. Seán Guerin SC

Chair of the Council of the Bar of Ireland

Law Library Ireland

GREEDWASHING

PTSB spend millions of EUROS every year sponsoring community initiatives across Ireland.

Just like the fossil fuel industry sponsorship programs known as GREENWASHING, corporations and banks do this kind of thing in a sycophantic attempt to ingratiate themselves with communities while they kick families out of their forests, as is the case with Texaco in the Ecuadorian Amazon, or as is the case here in Ireland with banks – such as PTSB, when they kick distressed mortgage holders out of their family homes.

I call it #GREEDWASHING.